In a nutshell, support lines show us a specific pricing level that has historically protected a currency pair from falling further down. To counter this, forex intraday traders will often place multiple buy and sell orders throughout the course of the day. This ensures that small gains quickly build up and thus – can make day trading lucrative for those that are able to consistently predict the currency market correctly. Most day traders will end up losing money, at least according to the data. Beginning traders should trade accounts with “paper money,” or fake trades, before they invest their own capital in order to learn the ropes, test out strategies, and employ the tips above.

- If you then find that a particular system or a forex trading strategy is working well for you, it will be much easier to identify this.

- Here, you’ll learn more about different strategies that forex day traders use as well as the risks involved.

- This means that the forex broker is required to keep client money protected in segregated bank accounts and keep crime away from the platform via KYC (Know Your Customer) processes.

- Movements in currency pairs are measured in pips, which stands for ‘percentage in point’ or ‘price interest point.’ Like EUR/USD, the majority of pairs are quoted at four or five decimal places.

- If it yields steady results, then don’t change it – with forex leverage, even a small gain can become large.

- Furthermore, the best forex brokers in this space will allow you to day trade with leverage.

She has worked in multiple cities covering breaking news, politics, education, and more.

What is better for day trading—forex or stocks?

A higher win rate for trades means more flexibility with your risk/reward, and a high risk/reward means that your win rate can be lower, and you’ll still be profitable. Much can be said of unrealistic expectations, which come from many sources, but often result in all of the above problems. Our own trading expectations are often imposed on the market, yet we cannot expect it to act according to our desires.

Rupee rises 24 paise to close at 82.99 against US dollar – BusinessLine

Rupee rises 24 paise to close at 82.99 against US dollar.

Posted: Fri, 08 Sep 2023 11:05:01 GMT [source]

There are five common forex day trading mistakes that can affect traders at any given time. These mistakes must be avoided at all costs by developing a trading plan that takes them into account. To handle these risks, a day trader must have a sufficient cushion of capital.

Learn how to manage day trading risk

Placing stop-loss orders to protect your open positions can save you plenty if the market turns against you, especially when exchange rates shift with extraordinary speed. Limit orders let you exit positions how to day trade forex or get into trades at a more favorable level than the market currently trades at. Managing your risk when day trading can be as important to your success as finding optimal entry levels for trades.

Traders looking to enhance profits should aim to trade during more volatile periods while monitoring the release of new economic data. Ideally, since day traders tend to be fairly active in the market, you’ll want a broker with tight dealing spreads to keep costs down. News trading consists of a short-term day trading strategy that uses breaking news about currencies or the nations that issue them to suggest trading opportunities. Positive news can create a buying opportunity, while negative news suggests a selling opportunity. Intraday, a trader must also accept what the market provides at its various intervals.

- A futures contract is a standardized agreement between two parties to take delivery of a currency at a future date and a predetermined price.

- Finally, day trading involves pitting wits with millions of market pros who have access to cutting-edge technology, a wealth of experience and expertise, and very deep pockets.

- You can do this by visiting the eToro homepage and clicking on the ‘Join Now’ button.

- They generally work alone and trade with their own risk capital from home.

- Since the trader has $5,000 and leverage is 30 to 1, the trader can take positions worth up to $150,000.

The forex market is very liquid, with trillions changing hands each day at a moment’s notice. This makes forex a popular market for traders that want to get exposure because of its volatility, without holding on to their positions overnight. Day traders employ a wide variety of techniques and strategies to take advantage of the perceived market inefficiencies.

Ultimately, if EUR/USD does hit a price of 1.2318, your stop-loss order will be triggered and thus – the trade will be closed automatically. On the other side of the scale, a ‘Golden Cross’ would occur if the 50-day moving average crosses from below the 200-day moving average to above. This would indicate that the forex pair is about to enter a bullish market. Making money consistently from day trading requires a combination of many skills and attributes—knowledge, experience, discipline, mental fortitude, and trading acumen. For example, the height of a triangle at the widest part is added to the breakout point of the triangle (for an upside breakout), providing a price at which to take profits.

Impact of News Releases on Forex Markets

Traders can also use trading strategies based on technical analysis, such as breakout and moving averages, to fine-tune their approach to trading. If this is your first-time day trading forex, https://g-markets.net/ it might be a wise idea to start off with the eToro demo account. This will enable you to day trade without risking any funds – with all buy and sell orders reflecting real market conditions.

News trading is one of the most traditional, predominantly short-term focused trading strategies used by day traders. To start, you must keep your risk on each trade very small, and 1% or less is typical. That means that if you have a $3,000 account, you shouldn’t lose more than $30 on a single trade. That may seem small, but losses do add up, and even a good day trading strategy will see strings of losses. Risk is managed using a stop-loss order, which will be discussed in the Scenario section below. It is important to take advantage of market overlaps and keep a close eye on news releases when setting up a trading schedule.

Trading Leverage

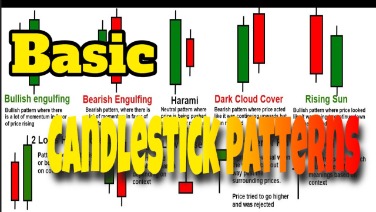

These are forex pairs that always consist of a strong currency that is traded against the US dollar. In order to be proficient at this form of price action analysis, seasoned forex traders will use technical indicators – of which there are dozens. Each indicator will look at a specific metric of a currency pair – such as support and resistance levels, volatility, and market sentiment.

If there’s an upward trend, you can expect a downward trend, or vice versa and an average level will appear in the long run. When using swing trading strategy, you’ll typically hold your position for shorter intervals compared to trend traders, who seek to take advantage of long-term market trends. We are now going to show you how to can start day trading forex from the comfort of your home with the best currency broker and the best day trading platform of 2021 – eToro.

Types of Markets

Scalping can be defined as a strategy where the trader aims to skim profits using small exchange rate movements from many trades to produce a profitable outcome. Here, you’ll learn more about different strategies that forex day traders use as well as the risks involved. The platform – which is used by over 20 million traders, offers dozens of forex markets.

GBP/USD Forecast: Looks for Support Against Greenback – DailyForex.com

GBP/USD Forecast: Looks for Support Against Greenback.

Posted: Fri, 08 Sep 2023 08:30:34 GMT [source]

In all but a few cases, you will never keep hold of an open position for more than a day. As such, you will need to be well versed in technical analysis to succeed in this segment of the forex trading scene. To successfully swing trade forex decide on the currency pairs you will be trading, the timeframe, and your entry and exit points.

Yes – the foreign exchange market is arguably the best asset class to target as a day trader. Not only can you trade 24/7 at industry-leading fees, but forex attracts trillions of dollars worth of volume each and every day. Plus, when trading major forex pairs, you will benefit from super-low volatility levels. Trend traders attempt to make money by studying the direction of asset prices, and then buying or selling depending on which direction the trend is taking. If the trend is upwards, with prices making a succession of higher highs, then traders would take a long position and buy the asset. If the trend is downwards, with prices making a succession of lower lows, then traders would take a short position by selling.