Bad debt only increases accounts receivable that are a part of this statement. Bad debt is an expense recognized by companies for receivable balances. It represents money owed by customers to a company that it does not deem recoverable. In other words, a bad debt expense is a charge for an irrecoverable receivable balance. Usually, companies record it when a customer fails to repay their owed amounts in time.

- Temporary timing differences create deferred tax assets and liabilities.

- According to the Generally Accepted Accounting Principles (GAAP), companies must follow this method due to the matching principle.

- It will then proceed to apply specific bad debt percentages based on historical trends and industry data to different age groups.

- These two forms of accounting involve different rules and calculations, and these differences can result in both deferred tax assets and deferred tax liabilities.

That’s why there is a high demand for bad debt recovery companies or (third-party) collection agencies. Bad debts end up as such because the debtor can’t or refuses to pay because of bankruptcy, financial difficulty, or negligence. These entities may exhaust every possible avenue to collect on bad debts before deeming them uncollectible, including collection activity and legal action. For example, if you complete a printing order for a customer, and they don’t like how it turned out, they may refuse to pay. After trying to negotiate and seek payment, this credit balance may eventually turn into a bad debt.

Journal Entry for allowance method:

Ultimately, you’ll still have received an average of 20% off for each coupon, but they gave you a much larger discount up-front that you slowly paid back over time. You’ll end up recognizing the income and expenses eventually, but you just may realize them sooner under one system than you do under the other. A debt becomes worthless when the surrounding facts and circumstances indicate there’s no reasonable expectation that the debt will be repaid. To show that a debt is worthless, you must establish that you’ve taken reasonable steps to collect the debt. It’s not necessary to go to court if you can show that a judgment from the court would be uncollectible. You may take the deduction only in the year the debt becomes worthless.

Essentially, a contra asset account is an account in the books that includes a negative asset balance. However, it reduces the value of a specific account reported in the financial statements. This process begins when a company does not expect customers to pay their owed amounts. As stated above, companies send invoices for each item sold to a customer.

How to Record Bad Debts

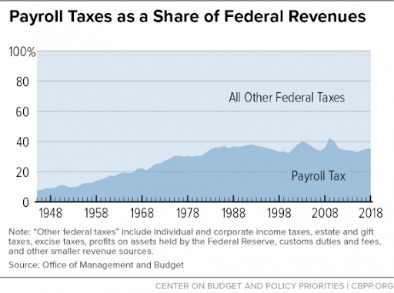

The percentages will be estimates based on a company’s previous history of collection. For corporations, deferred tax liabilities are netted against deferred tax assets and reported on the balance sheet. For pass-through entities like S corporations, partnerships, and sole proprietorships, the net appears on a supporting schedule on your business tax return. Temporary timing differences create deferred tax assets and liabilities. Deferred tax assets indicate that you’ve accumulated future deductions—in other words, a positive cash flow—while deferred tax liabilities indicate a future tax liability.

- For businesses that provide loans and credit to customers, bad debt is normal and expected.

- If a company’s bad debt deduction triggered an NOL carryover that has not expired, that constitutes a tax reduction, and the bad debt recovery must be reported as income.

- If you would like to know more about how deferred assets and liabilities impact your small business, be sure to contact your trusted accountant or tax professional.

- One option is to maintain a tight credit policy, so that only customers with excellent credit histories are granted credit by the firm.

For a discussion of what constitutes a valid debt, refer to Publication 550, Investment Income and Expenses and Publication 535, Business Expenses. Generally, to deduct a bad debt, you must have previously included the amount in your income or loaned out your cash. If you’re a cash method taxpayer (most individuals are), you generally can’t take a bad debt deduction for unpaid salaries, wages, rents, fees, interests, dividends, and similar items.

Temporary versus permanent tax differences

It’s recorded separately to keep the balance sheet clean and organized. A company will debit bad debts expense and credit this allowance account. This allowance can accumulate across accounting periods and may be adjusted based on the balance in the account. Bad debt expense is reported within the selling, general, and administrative expense section of the income statement. However, the entries to record this bad debt expense may be spread throughout a set of financial statements.

Macy’s, Inc. Reports Fourth Quarter and Full-Year 2022 Results – Macy’s, Inc.

Macy’s, Inc. Reports Fourth Quarter and Full-Year 2022 Results.

Posted: Thu, 02 Mar 2023 08:00:00 GMT [source]

For a bad debt, you must show that at the time of the transaction you intended to make a loan and not a gift. Bad debt expense is one way of accounting because some customers will not pay their accounts. It’s a reasonable and accepted accounting principle, and it’s crucial to properly account for this kind of debt expense by defining, notating and calculating it accurately. In addition, maintaining accurate records of doubtful debt expenses ensures that companies comply with standard accounting principles and avoid penalties.

Definition of Provision for Bad Debts

The balance isn’t hidden because it’s reported in the financial statements. Analysts can take deferred tax balances into account, so there’s no distortion of the financial picture. Certain tax incentives will create a deferred tax liability journal entry, giving the business some temporary tax relief, but will be collected later. Depreciation expenses—like the annual devaluation of a fleet of company vehicles—can generate deferred tax liabilities. Deferred tax assets and deferred tax liabilities are the opposites of each other. A deferred tax asset is a business tax credit for future taxes, and a deferred tax liability means the business has a tax debt that will need to be paid in the future.

Accordingly, the information provided should not be relied upon as a substitute for independent research. Intuit Inc. does not warrant that the material contained herein will continue to be accurate nor that it is completely free of errors when published. Differences in depreciation methods for book income and taxable income generate temporary differences. The IRS may allow a firm to use an accelerated method of depreciation, which generates more tax expense in the early years of an asset’s life and less expense in later years.

For example, interest income from municipal bonds may be excluded from taxable income on the tax return, but included in accounting (book) income. When you are sure that you can’t recover the amount, you lent your friend is when the ‘debt’ becomes bad debts. The definition remains the same in the business as well, but the treatment of bad debts is a little different. Better lines of communication between sales and AR departments also ensure there are no misunderstandings about the credit terms and early payment incentives Sales is allowed to offer. For example, by making it easier for Sales to access data on which customers are paying on time, late, and severely late, they can use it when negotiating credit terms with a customer.

Example of Bad Debt Expense

The project is completed; however, during the time between the start of the project and its completion, the customer fails to fulfill their financial obligation. You don’t know what years you’ll be eligible to use the carryforwards or whether you can use them all before the tax law prevents you from carrying the loss forward into future years. As a metaphor, imagine you used a rideshare service, but the car got a flat tire and you had to walk home in the rain. As compensation, the company sent a $50 credit to your account in the app. If you had planned to spend $50 on ridesharing the next month, you can now budget that your spending will actually be $0, because the credit you have will cancel it out. Tax reporting, on the other hand, calls for tax authorities to set the rules and regulations regarding the preparation and filing of tax returns.

It’s also worth noting that your historical percentage of collections will likely vary between bullish and bearish economic cycles. If your company has enough business history to reference how collections performed in different economic cycles, this can be helpful for casting predictions. We accept payments via credit card, wire transfer, Western Union, and (when available) bank loan. Some candidates may qualify for scholarships or financial aid, which will be credited against the Program Fee once eligibility is determined. Please refer to the Payment & Financial Aid page for further information. Consider a roofing business that agrees to replace a customer’s roof for $10,000 on credit.

What is bad debt expense?

Tax accounting and financial accounting have slightly different rules, which is why your business’s taxable income isn’t always the same as the net income on your financial statements. Accounts receivable is a permanent asset account (a balance sheet item) while sales is a revenue account (an income statement item) that resets every year. As a result, the steps you’ll take how much money can you deposit before it is reported to estimate your AFDA in this method are different compared to the percentage of sales method. In this method, the firm will initially club all outstanding accounts receivable (AR) by age and get an aggregate of the uncollectible amount. It will then proceed to apply specific bad debt percentages based on historical trends and industry data to different age groups.