Understand customer data and performance behaviors to minimize the risk of bad debt and the impact of late payments. Monitor changes in real time to identify and analyze customer risk signals. As can be seen the debit of 1,000 is unidentified and is posted as unclassified to the suspense account in the balance sheet. The suspense account is classified as a current asset, since it is most commonly used to store payments related to accounts receivable. It is possible to also have a liability suspense account, to contain accounts payable whose disposition is still being decided. If so, the liability suspense account is classified as a current liability.

A suspense account is also known as a difference in book account or an error account. GoCardless helps you automate payment collection, cutting down on the amount of admin your team needs to deal with when chasing invoices. Find out how GoCardless can help you with ad hoc payments or recurring payments.

Partial payments

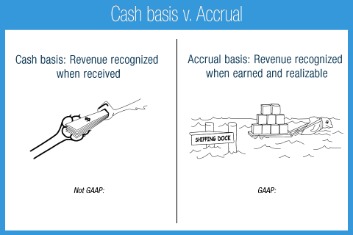

Patriot’s online accounting software is easy to use and made for the non-accountant. Because, even though reporting may be on cash basis, the program still makes all necessary calculations for accrual basis. You might not be able to access all transactions contributing to Suspense unless accrual basis is set. Emilie is a Certified Accountant and Banker with Master’s in Business and 15 years of experience in finance and accounting from large corporates and banks, as well as fast-growing start-ups. The bookkeeper is unable to balance the company’s trial balance, with the credit column exceeding the debit side by $500. Let’s suppose you have been alerted that a remittance someone sent you from abroad is ready for withdrawal.

- If you receive a partial payment from a customer, you may be unsure which invoice they are paying.

- Accordingly irrespective of the issue resulting in the suspense account posting, at the end of the accounting period the account balance reduces to zero with correcting journal entries.

- When the company gets the entire payment from the customer, they will debit $50 from the suspense account and credit the receivable accounts with the same amount.

- When debits and credits do not match, keep the difference in a suspense account until the problem is resolved.

- The errors which do not involve a suspense account will, when discovered, be corrected by means of a journal entry between the ledger accounts affected.

It’s like a makeshift shelf where all the “miscellaneous” items can be stored until their true nature can be determined. When we record uncertain transactions in permanent accounts, it can lead to balancing problems. It assists us in avoiding recording transactions in incorrect accounts. However, we must ensure that the suspense account balance is zero and that all entries are transferred to their respective accounts in order to provide a more accurate representation of our books. A suspense account is one in which unclassified transactions are recorded.

Example #1: Receiving a partial payment

Suspense accounts are temporarily classified as a balance sheet account, usually under the heading of current assets or current liabilities depending on the normal balance. Consequently at the end of each accounting period the business carries out a suspense account reconciliation. Any balance is investigated so that correcting adjustments can be made before the final financial statements are issued.

The suspense account can have a debit or a credit balance, depending on which side the trial balance is short. Ideally, a business will have a zero balance in the suspense account—or no suspense account listed—in its financial statements. An incomplete transaction should neither be overlooked nor entered improperly. The suspense account provides a place for accountants to temporarily log and track incomplete transactions until more information is obtained.

Reconciliation: How to Reconcile Suspense Accounts?

Automatically create, populate, and post journals to your ERP based on your rules. Harold Averkamp (CPA, MBA) has worked as a university accounting instructor, accountant, and consultant for more than 25 years. The accountant identifies the open invoice against which the amount of 50,000 is to be settled. Extracts of the balance sheet have been attached for better understanding. In this article, we will learn about the subsidiary books, it’s types and purchase return books. Deposits or withdrawals are made for transactions that are yet to be completed.

There are several situations for holding an entry in a suspense account. Manager is designed to preserve information rather than reject incorrect entries. But when anything is in your Suspense account, your records and reports are almost certainly wrong. In this article, we will learn about the balance of Suspense Account, the use of a suspense account and examples of suspense account.

Trial Balance

He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries. He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own. He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University. Similarly, if a borrower pays more than they owe for a particular month—without designating how those funds should be applied—the servicer may put the extra money into a suspense account for the time being. A mortgage servicer can use a suspense account to hold funds when a borrower falls short on their required monthly loan repayment, possibly by accident.

CBSE Class 11 Accountancy Syllabus 2024: Class 11th Accountancy Syllabus Download PDF – Jagran Josh

CBSE Class 11 Accountancy Syllabus 2024: Class 11th Accountancy Syllabus Download PDF.

Posted: Mon, 17 Apr 2023 07:00:00 GMT [source]

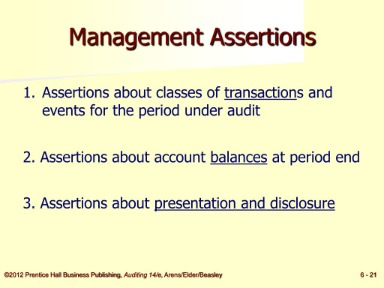

Working capital, cash flows, collections opportunities, and other critical metrics depend on timely and accurate processes. Ensure services revenue has been accurately recorded and related payments are reflected properly on the balance sheet. While you are innovating to produce safe, reliable, and sustainable products and services, our solutions help accounting teams save time, reduce risk, and create capacity to support your organization’s strategic objectives. Regardless of the issues in question, suspense accounts are cleared out once the problem is addressed, at which time the funds are promptly re-shuffled to their correctly designated accounts. At that point, the suspense account should achieve a balance of zero dollars. While there is no definitive timetable for conducting a clearing-out process, many businesses try to regularly accomplish this on a monthly or quarterly basis.

What Is a Suspense Account? How It Works, Types, and Example

Hold the partial payment in a suspense account until you contact the customer. When you find out the invoice, close the suspense account and move the amount to the correct account. Eventually, you allocate entries in the suspense account to a permanent account.

The term “suspense account” can have several different meanings, depending on the context. In the business world generally, a suspense account is a section of a company’s financial books where it can record ambiguous entries that need further analysis to determine their proper classification. If it’s an asset in question, the suspense account is a current asset because it holds payments related to accounts receivable. A suspense account could also be a liability if it holds accounts payables that you don’t know how to classify. A suspense account is an account where you record unclassified transactions.

They ensure that you account for all transactions accurately in your books. If you don’t know who made the payment, look at your outstanding customer what is bad debt the method of bad debts written off and protection invoices and find which one matches the payment amount. Contact the customer to verify that it’s their payment and the right invoice.

BlackLine’s foundation for modern accounting creates a streamlined and automated close. We’re dedicated to delivering the most value in the shortest amount of time, equipping you to not only control close chaos, but also foster F&A excellence. Centralize, streamline, and automate intercompany reconciliations and dispute management.Seamlessly integrate with all intercompany systems and data sources. Automatically identify intercompany exceptions and underlying transactions causing out-of-balances with rules-based solutions to resolve discrepancies quickly. It is used only because a proper account for a particular transaction couldn’t be determined at the time when the transaction was recorded.